Project Background

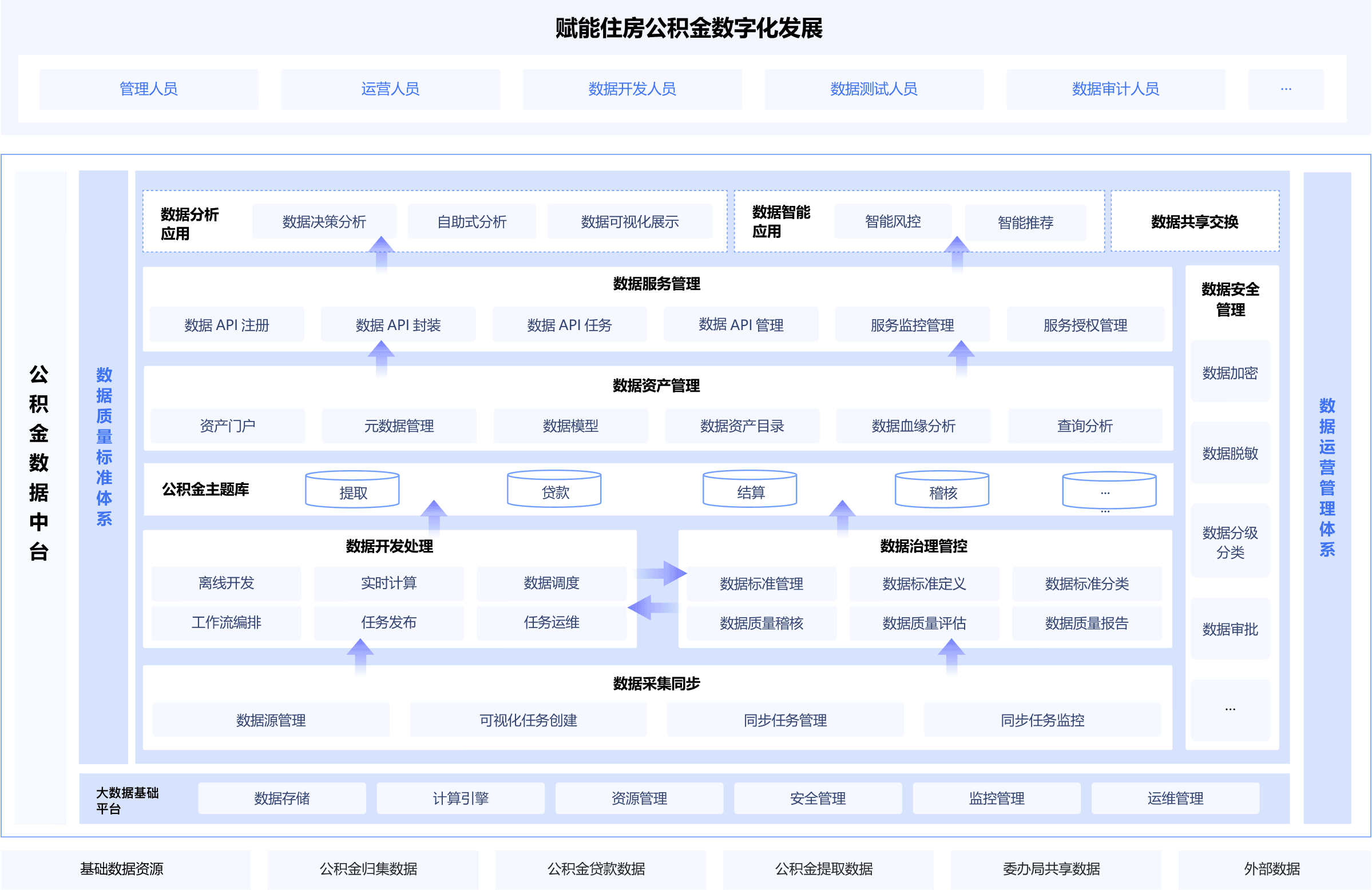

With the rapid development of digital technology, the digital transformation of housing provident fund business has become an important means to improve operational efficiency and meet customer needs. To implement the decisions and deployments of the Party Central Committee and the State Council on accelerating digital economic development and digital society construction, the Ministry of Housing and Urban-Rural Development has proposed the "Guidelines on Accelerating Digital Development of Housing Fund". Housing fund business is related to the vital interests of contributors and is one of the most concerned business operations for contributors. The advancement of digital transformation needs to ensure the security and efficient utilization of business data. The construction of the housing fund big data platform aims to integrate internal and external data, enhance real-time computing capabilities, break information silos, achieve efficient data sharing and orderly utilization, and enable immediate processing and analysis of business data, improving the operational efficiency and risk prevention capabilities of housing fund business, providing convenient, efficient, and real-time data services for contributors.

Issues and Requirements

-

01

Lack of unified planning and management of data, information silo construction, leading to data stored in heterogeneous, scattered databases, difficult to share, and challenging to perform data correlation analysis.

-

02

Risk analysis faces issues such as diversity, large data volume, and low efficiency, with single-machine data storage and analysis engines unable to meet performance and business requirements.

-

03

When processing loan applications, multiple credit inquiries are required, making it difficult to promptly understand the risk status of credit subjects, affecting the efficiency of business processing.

-

04

Lack of technical means for refined management of housing fund management business, unable to clearly, intuitively, accurately, and comprehensively grasp the center's business situation.

Solution

Solution Benefits

-

Data Assetization

Aggregates internal and external data, unifies standards and governance, improves data governance level; establishes asset management and operation system, facilitating long-term data management and utilization.

-

Intelligent Decision Making

Builds dozens of digital dashboards covering center overview, business themes, channel services, cross-domain collaboration, data sharing, risk monitoring, etc., supporting decision-making, providing comprehensive and accurate data support for leadership, and helping ensure the scientific and accurate nature of decisions.

-

Intelligent Risk Control

Establishes user profile system and combines big data modeling and development capabilities to build risk management model library, reducing the risk of fraudulent withdrawals and loans, improving risk prevention capabilities, and ensuring business operation security.

-

Credit Value Realization

Establishes a credit subject evaluation management system interconnected with municipal public credit information system for mutual recognition of results; applies to business processing and approval, reducing the risk of fraudulent withdrawals and loans, improving business processing efficiency, and promoting maximum utilization of credit value.

-

Business Digitalization

Supports user profile system, credit evaluation system, intelligent risk control system, and data sharing control system; achieves comprehensive business digital management and service improvement, meeting customer needs and enhancing market competitiveness.

Related Products

Representative Clients

Learn more,

start your data intelligence journey now

Contact Us (09:00-18:00)

Technical Support

support@keendata.com